jersey city property tax rates

In any case in a state where the average municipal tax rate is 24 and. All real property is assessed according to the same standard.

Property Tax Calculator Smartasset

Jersey Citys average tax rate is 167 of assessed home valuesslightly lower than the New Jersey state average of 189.

. Cuts in services or programs early retirements and other measures including a tax increase will have to be considered. Hudson County collects on average 167 of a propertys assessed. This property tax rate is slightly lower than the average tax rate in New Jersey of 189 but it is still considered.

Under Tax Records Search select. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900. Based on this rate and average market.

It is equal to 10 per 1000 of the propertys taxable value. Account Number Block Lot Qualifier Property Location 18 14502 00011 20. The remaining 63 of the property.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey. NEW -- New Jersey Map of Median Rents by. New Jersey Property Taxes Go To Different State 657900 Avg.

New Jersey Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value. Compare your rate to the New. As an introductory frame.

Below is a town by town list of NJ Property tax rates in Somerset County. The current total local sales tax rate in Jersey City NJ is 6625. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a.

Left click on Records Search. The December 2020 total local sales tax rate was also 6625. Under Tax Records Search select Hudson County and Jersey City.

The average of assessed home values in the county for 2021 was 312831. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Left click on Records Search.

The General Tax Rate is used to calculate the tax assessed on a property. City of Jersey City Tax Assessor. Jersey Citys 2021 school tax rate was 052 and Jersey City sent 37 of their property tax dollars to the schools.

Jersey City New Jersey 07302. New Jerseys real property tax is an ad valorem tax or a tax according to value. Jersey City Hall 280 Grove Street Room 116.

A property tax is levied on the citys residents and businesses. TO VIEW PROPERTY TAX ASSESSMENTS. North Plainfield has the highest property tax rate in Somerset County with a.

General Property Tax Information. Online Inquiry Payment. The average tax rate was 4301.

Somerset County Property Taxes. The average 2021 property tax bill in Hudson County was 9009. Jersey City Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent informed about your property bill.

11 rows City of Jersey City. Portions of Jersey City are part of the Urban.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

U S Cities With The Highest Property Taxes

Bergen County Nj Property Property Tax Rates Average Tax Bills And Home Assessments

Property Taxes Urban Institute

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Tax Collector S Office City Of Englewood Nj

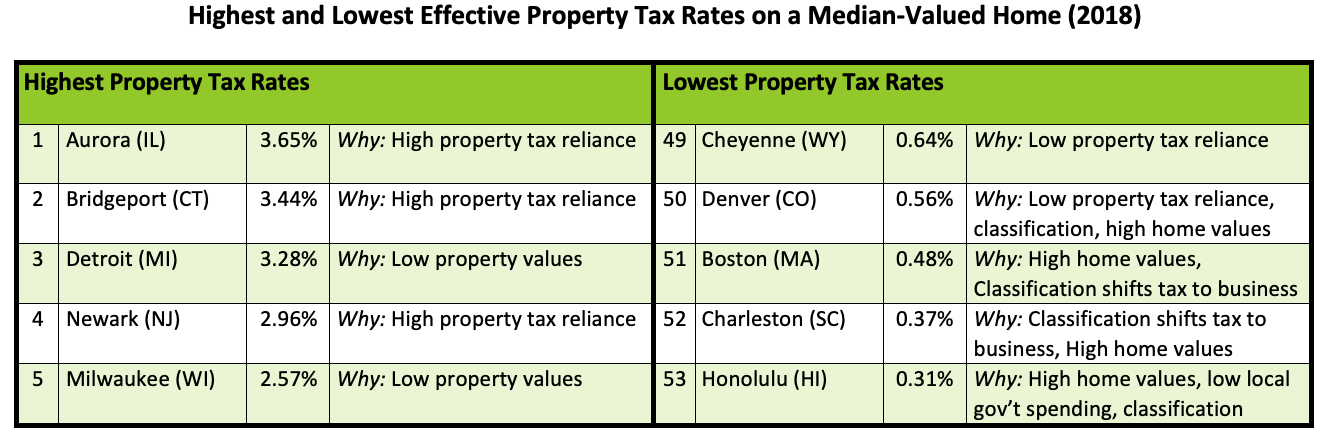

Study Cities With Highest Lowest Property Taxes

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Property Taxes In The Us A State By State Look At What You Ll Pay

Council Authorizes Mailing Of Higher Tax Bills To Homeowners

Property Tax Lincoln Institute Of Land Policy

Property Taxes By State How High Are Property Taxes In Your State

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Interactive Map The High Low And In Between Of Nj S Property Taxes Nj Spotlight News

U S Cities With The Highest Property Taxes

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom